This Is What Quiet Compounding Looks Like

Extensive Portfolio Update (Part IV)

Investing is like watching paint dry or watching grass grow.

You buy wonderful companies and... do nothing.

Let’s see which companies are interesting today.

This is the fourth part of this extensive Portfolio Update.

Novo Nordisk

How does the company make money?

Novo Nordisk makes money by developing and selling pharmaceutical products, with diabetes and obesity treatments (notably insulin and GLP-1 drugs) as its main revenue drivers.Weight in Portfolio: 6.1%

Performance (%): +4.2%

Update investment case

Novo Nordisk is without doubt the most discussed stock in the Community right now.

The main reason? The stock is very volatile.

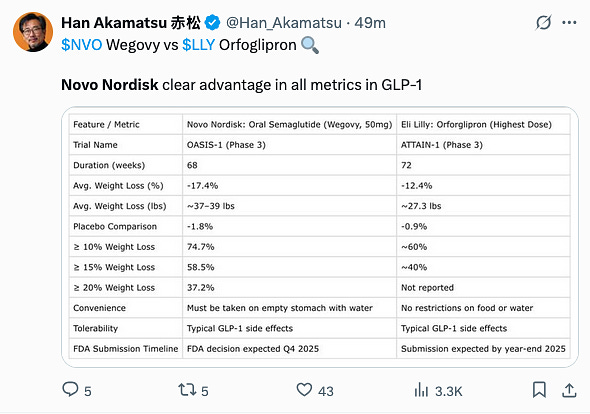

It seems like everyone tends to agree that Eli Lilly will dominate the industry while Novo Nordisk will keep struggling.

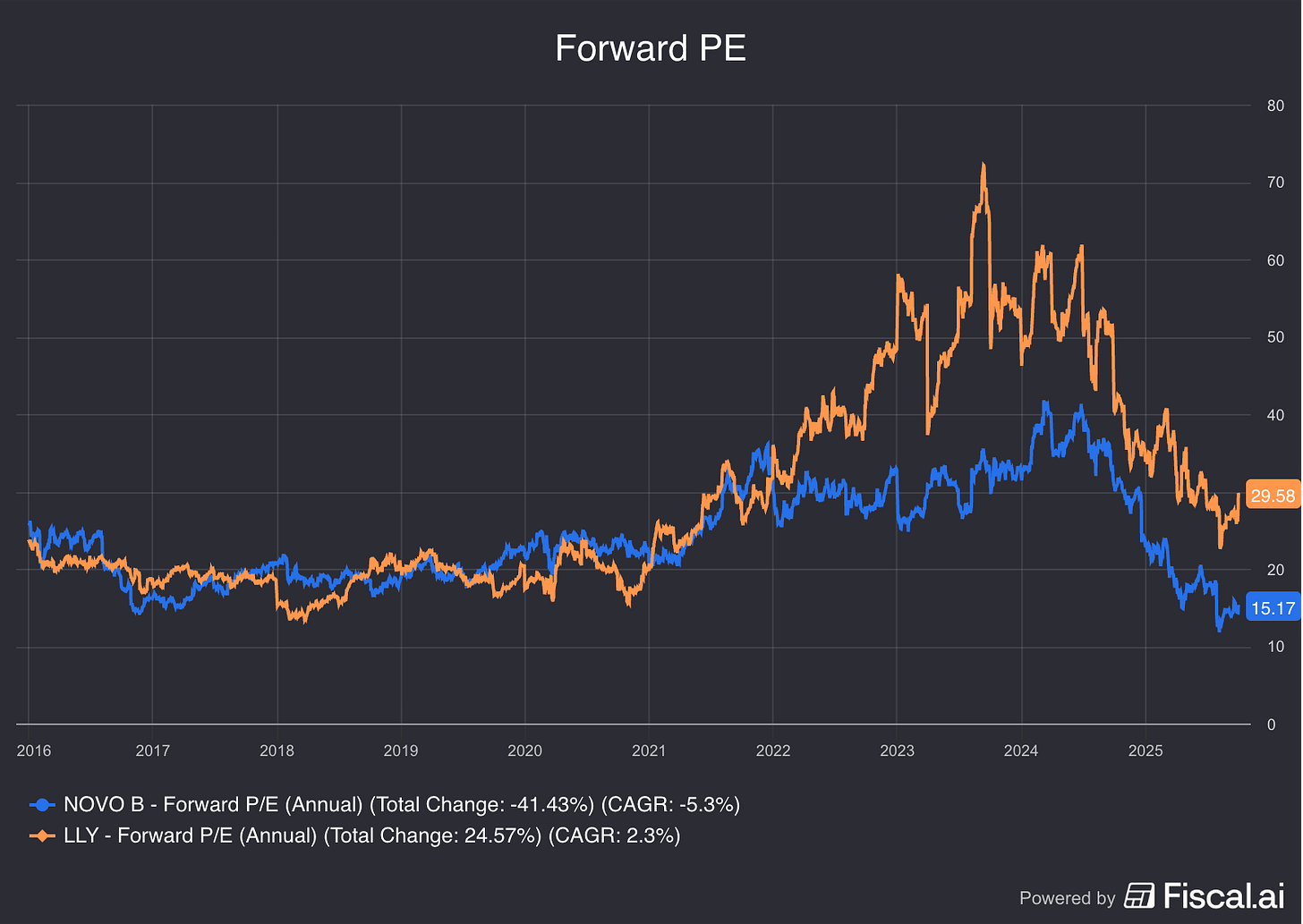

Today, Novo Nordisk is twice (!) as cheap as Eli Lilly.

Forward PE Novo Nordisk: 15.2x

Forward PE Eli Lilly: 29.6x

I have a strong conviction that the valuation of Novo Nordisk and Eli Lilly will converge to each other.

Between 2016 and 2022, both companies were valued more or less at the same valuation level.

And guess what? It’s not the case that Eli Lilly is outperforming Novo Nordisk on all metrics. Just look at this tweet from Han Akamatsu:

And it’s also not true that Novo Nordisk will be hurt massively from import tariffs.

Novo Nordisk is doubling down on U.S. production. They’re investing $4.1 billion in a new factory in North Carolina to reduce reliance on imports. This means they are heavily increasing their local capacity.

Some other key happenings:

Novo Nordisk plans to cut 9,000 jobs (11% of its workforce, including 5,000 in Denmark) to save billion DKK annually by 2026, with one-off restructuring costs also totaling 8 bn kroner, due to increased competition.

Mike Doustdar took over the CEO role since 7 August this year. I think some ‘kitchen sinking’ took place.

What is kitchen sinking?

The concept refers to a company deliberately disclosing or accelerating negative news and poor results before a new CEO takes over, so the incoming leader starts with a “clean slate” and the stock has already absorbed the bad news.I also would like to share this personal experience from a member in the community with you:

I want to share my personal experience with a GLP-1 drug, which has been truly life-changing after years of struggling with weight gain and worsening health markers despite disciplined exercise and a strict low-carb diet. In just three weeks of taking an oral GLP-1 treatment, my blood sugar has normalized, my inflammation has gone down, my blood pressure has improved, and I’m losing weight. Most importantly, I finally feel in control of my food cravings. These drugs feel more like hormone correction than simple weight-loss tools, giving me transformative health benefits that diet and exercise alone couldn’t provide. Affordable, effective, and accessible GLP-1s have the potential to reshape medicine—and I believe this will also create major opportunities for companies like Novo and Lilly.Here’s an interesting valuation update Jochen Vandenbergh did on Novo Nordisk:

I did a quick scenario analysis based on the DKK 27.5 billion revenue forecast for 2030.

The other assumptions are:

8% revenue growth over the next five years. This is conservative, given that revenue CAGR over the past five years was 22%. The obesity pill will likely shift revenue between treatments, and the lower growth assumption of 8% more than compensates for this.

As an exit multiple, I used EV/Sales of 8. This is higher than today’s level, but I don’t believe Novo Nordisk will remain this cheap over the next five years. It is also still below the 10-year average of 9.2%. For comparison, Eli Lilly currently trades at an EV/Sales of 13, so 8 seems reasonably conservative in my view.

Running the numbers, this implies a CAGR of about 8% for Novo Nordisk, excluding dividends. Add another 2–3% from dividends, and you get above 10%. And this is based on conservative assumptions.

It proves that Novo Nordisk is very cheaply valued today.

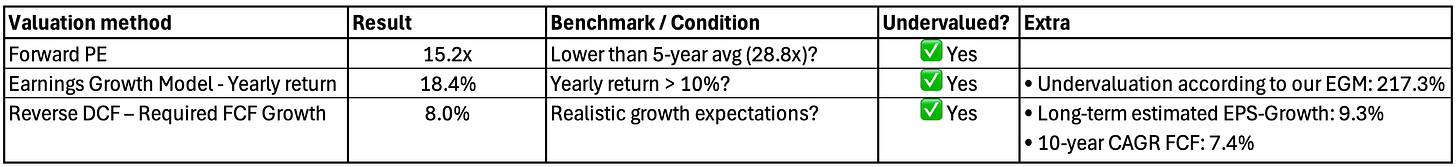

Current valuation level

Expectations intrinsic value

Expected growth intrinsic value 2026: 9.4%

Expected growth intrinsic value in the long term: 12.5%

Conviction level

8.5/10: Novo Nordisk is a high-quality compounder on the operating table. The end market for Eli Lilly and Novo Nordisk is big enough for both to do very well.