Hi Partner 👋

I’m Pieter and welcome to a 🔒subscriber-only edition 🔒of Compounding Quality.

If you’re not a subscriber, here’s what you missed this month:

Subscribe to get access to these posts, and every post.

Ferrari is the definition of a luxury car.

The stock compounded at 27% per year since its IPO in 2015.

But is it an interesting investment? Let’s find out today.

Ferrari - General Information

👔 Company name: Ferrari

✍️ ISIN: NL0011585146

🔎 Ticker: RACE

📚 Type: Owner-Operator

📈 Stock Price: €397 EUR

💵 Market cap: €77 billion

📊 Average daily volume: $101 million

Please note that we also have investment cases of S&P Global, LVMH, Copart, Mastercard, Fortinet, Lululemon Athletica, Adobe, Adyen, and Novo Nordisk on the website.

👏 Special thanks to our Partner Tom for preparing this investment case 👏

Onepager

Here’s a onepager with the essentials of Ferrari:

(Click on the picture to expand)

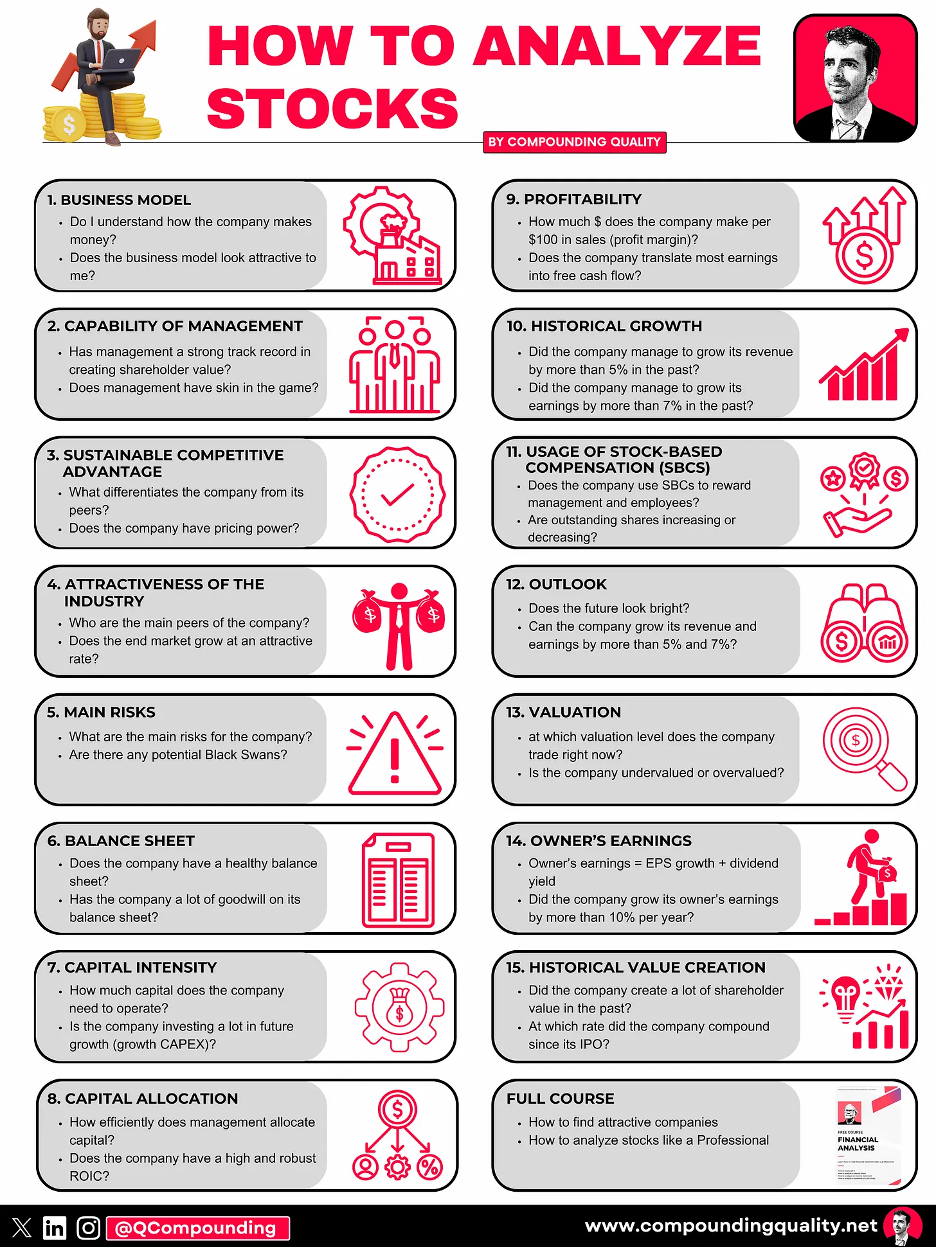

15-Step Approach

Now let’s use our 15-step approach to analyze the company.

At the end of this article, we’ll give Ferrari a score on each of these 15 metrics. This results in a Total Quality Score.

1. Do I understand the business model?

Ferrari is the definition of luxury.

It has a rich history in sports cars and is a brand that symbolizes exclusivity, innovation, and state-of-the-art performance.

The company was founded by Enzo Ferrari in 1947 as a means to fund his racing team, Scuderia Ferrari, with which the brand has become synonymous.

Ferrari is one of the world’s leading luxury brands, focused on the design, engineering, production, and sale of the world’s most recognizable luxury performance sports cars.

Not many businesses in the world can say they “choose” their clients, Ferrari is one of them. Ferrari has successfully integrated its racing heritage with its ultra-premium brand strategy, focusing on exclusivity and luxury. The company limits its annual production to maintain scarcity, ensuring demand consistently outstrips supply. This strategy bolsters the resale value, ensures its ultra-luxury status continues, and maintains its unique brand reputation.

In 2023, Ferrari produced 13,336 cars, of which 74% were sold to existing clients, and within that, 40% owned one or more Ferraris. New models tend to range from $250,000 to several million for limited edition models.

Ferrari’s current revenue split looks as follows:

Cars and Spare Parts (89.9% of sales): Selling new Ferrari cars and the necessary spare parts for them.

Sponsorship, Commercial, and Brand (10.1% of sales): Income from sponsorship deals, commercials, and branded merchandise.

Source: Finchat

2. Is management capable?

Enzo Ferrari founded the company in 1929. He ran the company until he died in 1988.

After Enzo's death, his son, Piero Ferrari (who still owns 10% of the company), became more actively involved in the company's management. Today, Piero Ferrari is still the Vice Chairman of the business.

Since September 2021, Benedetto Vigna has been the CEO. Before joining Ferrari, Vigna came from a technology background at STMicroelectronics, where he was the president of the Analog, MEMS, and Sensors Group.

The top shareholders of Ferrari are:

Exor N.V. - Controlled by the Agnelli family, owning around 24% of Ferrari's common shares.

Piero Ferrari – Son of Enzo Ferrari, holds 10% of the common shares.

Picture: Enzo Ferrari (right) with his son Piero Ferrari (left)

3. Does the company have a sustainable competitive advantage?

Ferrari’s competitive advantage is difficult to articulate in words.

It is one of those truly special brands everyone knows about, yet it is not every day you see a Ferrari cruising down the street.

The company’s competitive advantage is based on two main pillars:

Strong brand name

Relentless focus on client relationships

Ferrari’s strongest competitive advantage lies in its unparalleled brand prestige. It represents a heritage of success in motorsport and a commitment to luxury and exclusivity. Its brand is embedded with the history of its Formula 1 team, and Ferrari's legacy as an original racing team makes it one of the few global sports franchises.

Secondly, Ferrari takes an exceptionally personalized approach to client relationship management. Each Ferrari customer is considered a part of an exclusive club, and the company goes to great lengths to ensure its unique customer experience. The purchase of a Ferrari is usually just the beginning of a client relationship.

Companies with a sustainable competitive advantage are often characterized by the following:

Gross Margin: 48.9% (Gross Margin > 40%? ✅)

ROIC: 22.5% (ROIC > 15%? ✅)

Source: Finchat

4. Is the company active in an attractive end market?

The market for luxury cars is an attractive niche.

Luxury Car Market Insights expects that the end market will grow at a CAGR of 9.2% per year until 2031.

Most customers are price inelastic. This means the demand for a Ferrari is not heavily influenced by the economic cycle.

Its target market and existing customer base consist of high-net-worth clients and collectors.

The key rivals of Ferrari are Lamborghini, Porsche, Mclaren, Aston Martin, Bugatti, Maserati and Bentley.

5. What are the main risks for the company?

Here are some of the key risks for Ferrari:

Brand image and reputational risk

Transition to EVs and advancements in technology within the automotive industry

Supply chain issues and supplier risk with over 500 unique partners

The success of the Formula 1 team correlates in part to the brand's success

Although performance in recent years has not been strong, this has not materially impacted the business

Key person risk regarding craftsmen with cars made by hand

Laws and regulations on fuel and emissions

Rich valuation (see later)

6. Does the company have a healthy balance sheet?

We look at three ratios to determine the healthiness of Ferrari’s balance sheet:

Interest Coverage: 55.1x (Interest Coverage > 15x? ✅)

Net Debt/FCF: 1.0x (Net Debt/FCF < 4x? ✅)

Goodwill/Assets: 9.8% (Goodwill/assets not too large? < 20% ✅)

Ferrari has a very strong balance sheet.

Source: Finchat

Now let’s dive into the most important fundamentals of Ferrari.

We will give the company a Total Quality Score and determine whether it’s an interesting stock to buy.