Quality Investing Universe

Investing is an art.

But it’s also a craft and a science at the same time.

Let’s show you a great Quality Investing Universe today.

Screen for Quality

The beautiful thing? I keep learning about Quality Investing every single day.

Quality Investing can be summarized as investing in the best companies in the world.

You can use three easy steps:

Buy wonderful companies

Led by excellent managers

Trading at fair valuation levels

Finchat does an excellent job of providing us with the data needed to find & analyze quality companies.

Let’s use the following criteria to screen for some ideas:

Net Debt/EBITDA < 2

Net Profit Margin > 10%

5-year average ROIC > 20%

Historical 5-year revenue CAGR > 10%

Historical 5-year EPS CAGR > 12%

Expected EPS growth next 2 years (CAGR) > 12%

The following companies match these criteria:

A lot of great companies match these criteria.

Think about Microsoft, Mastercard, Adobe, Fortinet, Veeva Systems, Deckers Outdoor, and many more.

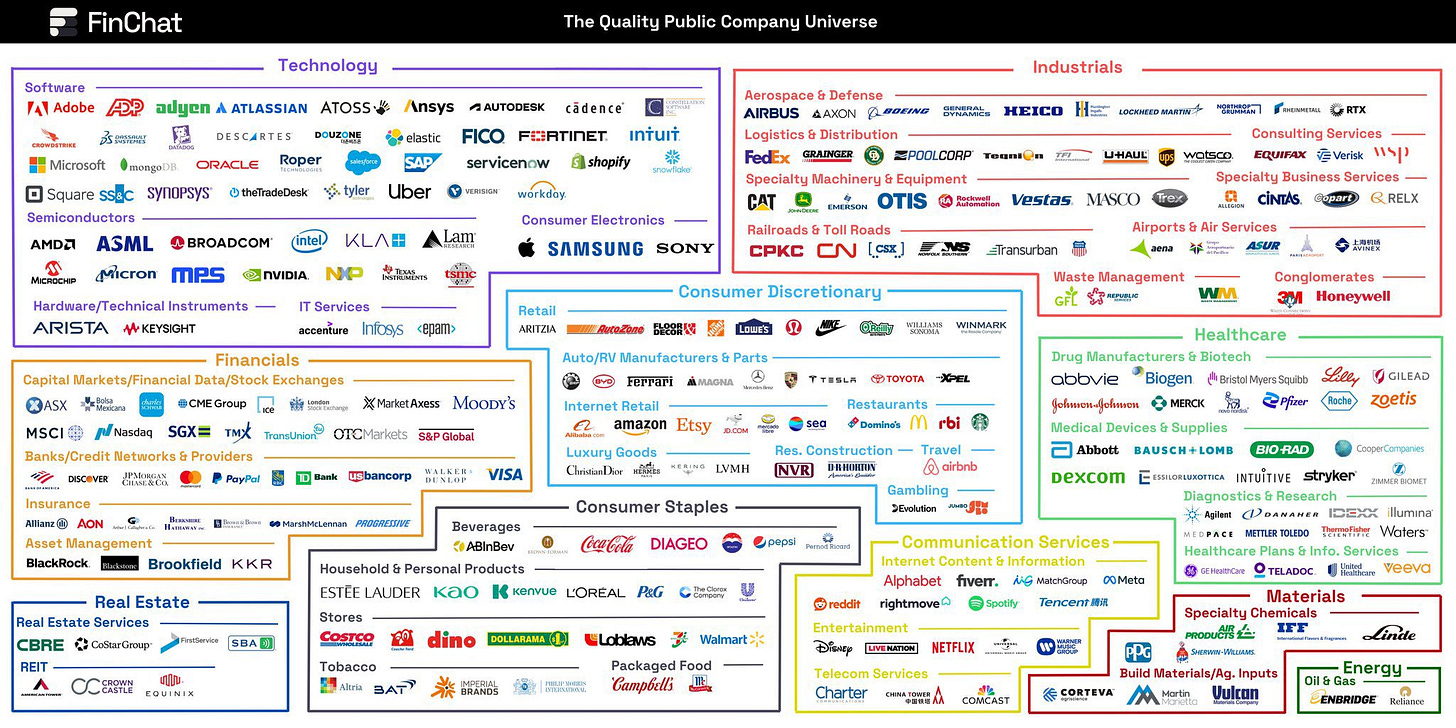

Quality Universe

What’s even better?

Finchat worked very hard to create a quality universe.

I love it as it’s a great pond to fish in.

I am quite sure that when you create an ETF with all the companies mentioned in this list, you’ll do very well in the long term.

Here are some companies that stand out to me per sector…

Technology: Adobe and Constellation Software

Adobe: Adobe is a great SaaS company with predictable cash flows. The recent 20% decline might offer opportunities.

Constellation Software: Constellation Software is the best serial acquirer in the world led by Mark Leonard.

Financials: Visa and MSCI

Visa: I don’t know many companies as strong as Visa (and Mastercard). Digital payments are in a clear secular trend and Visa will benefit from this.

MSCI: MSCI manages over $98 trillion (!) in assets. 97% (!) of their revenue is recurring in nature.

Real Estate: CoStar Group and Crown Castle

CoStar Group: CoStar is a leading provider of real estate data and analytics, benefiting from growing demand in the digital transformation of the industry.

Crown Castle: Crown Castle is a REIT and provider of shared communications infrastructure. They’ve grown their EPS at a CAGR of 18% (!) over the past decade.

Consumer Discretionary: Autozone and Domino’s Pizza

Autozone: Autozone is a retailer and distributor of automotive replacement parts and accessories. The company heavily buys back its own shares

Domino’s Pizza: Domino’s Pizza is the best pizza franchise company in the world. DPZ compounded at a CAGR of 23.3% since 2004.

Consumer Staples: Dino Polska and Estée Lauder

Dino Polska: Dino Polska can be seen as the ‘Polish’ Costco. It’s a retail company that is way more efficient than its peers.

Estée Lauder: Estéé Lauder is a global leader in luxury beauty products (skincare, makeup, fragrance, haircare, …). The stock is down 50% (!) YTD.

Industrials: Copart and Heico

Copart: Copart makes money via online vehicle auctions. They buy and sell used and salvaged vehicles.

Heico: Heico is a leading aerospace and defense company specializing in aircraft replacement parts and niche electronic components.

Healthcare: Zoetis and Danaher

Zoetis: Zoetis produces vaccines, medicines, diagnostics, and other technologies for pets and livestock.

Danaher: Danaher is a global science and technology innovator, operating through diverse segments in life sciences, diagnostics, and environmental solutions.

Communication Services: Meta Platforms and Rightmove

Meta Platforms: Meta Platforms, formerly Facebook, is a global technology company that owns Facebook, Instagram, WhatsApp, and Oculus.

Rightmove: Rightmove is the UK’s largest online real estate marketplace, connecting buyers, renters, and sellers with property listings and offering a range of digital tools.

Finchat

It’s a joy to call Finchat a Partner.

The good news? If you take a subscription before next Monday (2 December), you get a discount of 25%.

Take advantage by clicking on the picture:

Everything In Life Compounds

Pieter

PS Did you already see our Black Friday offer?

🚨If you subscribe this week you get access to My Mersonal Portfolio for just $399. A 66.66% discount! 🚨

You can become a Partner here: