🏰 10 Investment Ratios

It’s #QualityTuesday!

In this series, I’ll teach you 5 things about the stock market in less than 5 minutes.

1️⃣ 10 Investing Ratios

Ratios can make your life a lot easier as an investor.

Here are 10 ratios everyone should know:

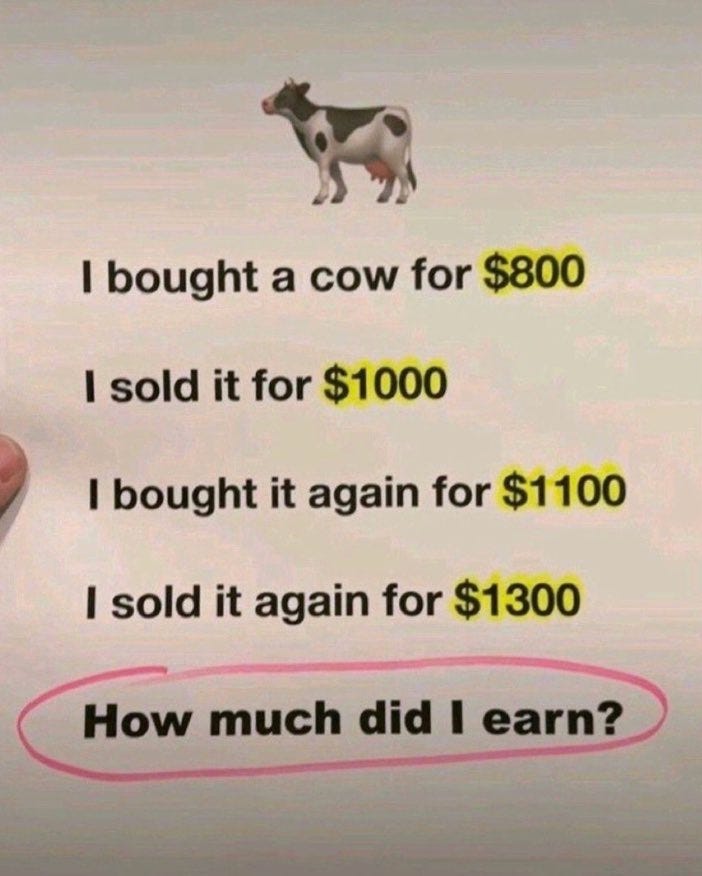

2️⃣ How much did I earn?

I have a riddle for you. How much did I earn?

3️⃣ One simple investment quote

The most important thing in evaluating businesses is figuring out how big the competitive advantage is.

You look for economic castles protected by unbreakable moats.

"If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done." - Warren Buffett

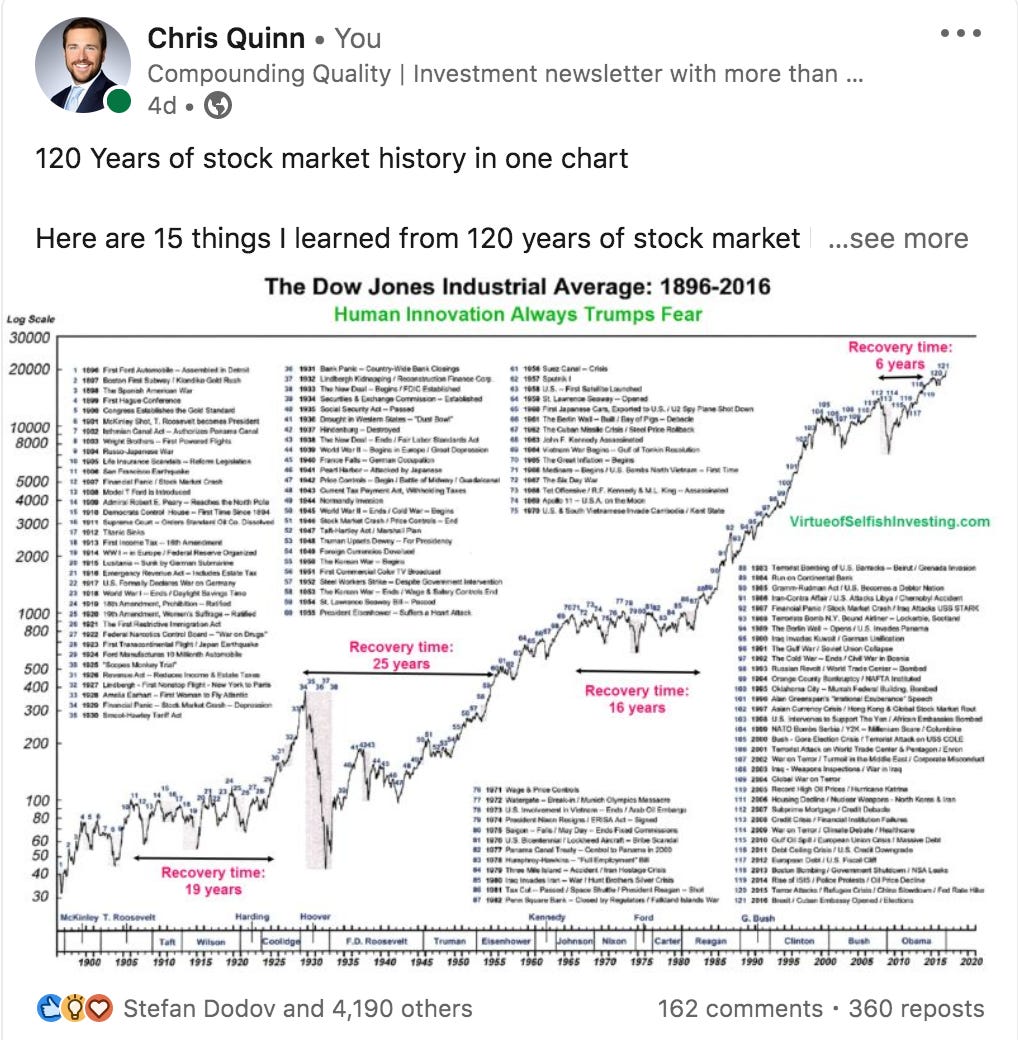

4️⃣ 120 Years of stock market history

Recently, I started publishing investment wisdom on LinkedIn.

In this post, you’ll find 15 things I learned from 120 years of stock market history.

It would be an honor if you could follow me on LinkedIn too!

5️⃣ Example of a Quality Company

SS&C Technologies develops and markets computer software for financial services providers. The software enables trading and modeling, portfolio management and reporting, accounting, performance measurement, reconciliation, reporting, processing, and clearing.

FCF Margin: 17.5%

ROIC: 6.0%

FCF Yield: 4.3%

Exp. FCF Growth (3 yr): 16.5%

CAGR since IPO: 17.7%

More articles from Compounding Quality

Do you want to read more? Here are our 5 latest articles:

That’s it for today

That’s it for today.

Do you want to read more from Compounding Quality? Please subscribe to my newsletter where I provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. I’ve read over 500 investment books and spend more than 50 hours per week researching stocks.

Thanks for sharing

I love this, thanks for sharing.! I actually got the riddle right. :)