🔍 Screen for Quality Stocks

How to find the best companies in the world

Everyone wants to own the best companies in the world.

But how can you find them?

In this article I’ll show you how you can screen for quality stocks yourself.

Screen for Quality Stocks

A great friend of mine developed this beautiful framework to find quality stocks:

Revenue growth > 5%

Earnings growth > 7%

FCF / earnings > 80%

ROIC > 15%

Net debt / FCFF < 5

Debt/equity < 80%

When you screen for these criteria, you find companies like Mastercard, Visa, Alphabet, Monster Beverage, Microsoft, and Apple.

These are companies you wanted to own over the past decade, right?

Now let’s find out why these criteria are important and how you can screen for quality stocks yourself.

Revenue growth > 5%

Organic growth is the most preferred source of growth.

In the long term, revenue growth is the main driver for stock market returns.

Why? Because without top-line growth, a company can never grow its free cash flow per share at an attractive rate in the long term.

Earnings growth > 7%

In the end, you want most sales to be translated into earnings.

Why? Because in the long term stock prices always follow the underlying performance of the company.

You can calculate your return as an investor as follows:

Return = Earnings per share growth + Shareholder yield (Dividend yield + Buyback yield) +/- Multiple Expansion (Contraction)

If you don’t overpay for a company that can grow its earnings per share at attractive rates, you’ll do very well.

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” - Warren Buffett

FCF/Earnings > 80%

Earnings are an opinion, free cash flow is a fact.

Companies that translate most earnings into free cash flow perform significantly better than companies which don’t.

“An academic study found that from 1962 through 2001, the firms which translated most earnings into free cash flow outperformed those which translated the least earnings into free cash flow with 18% (!) per year.

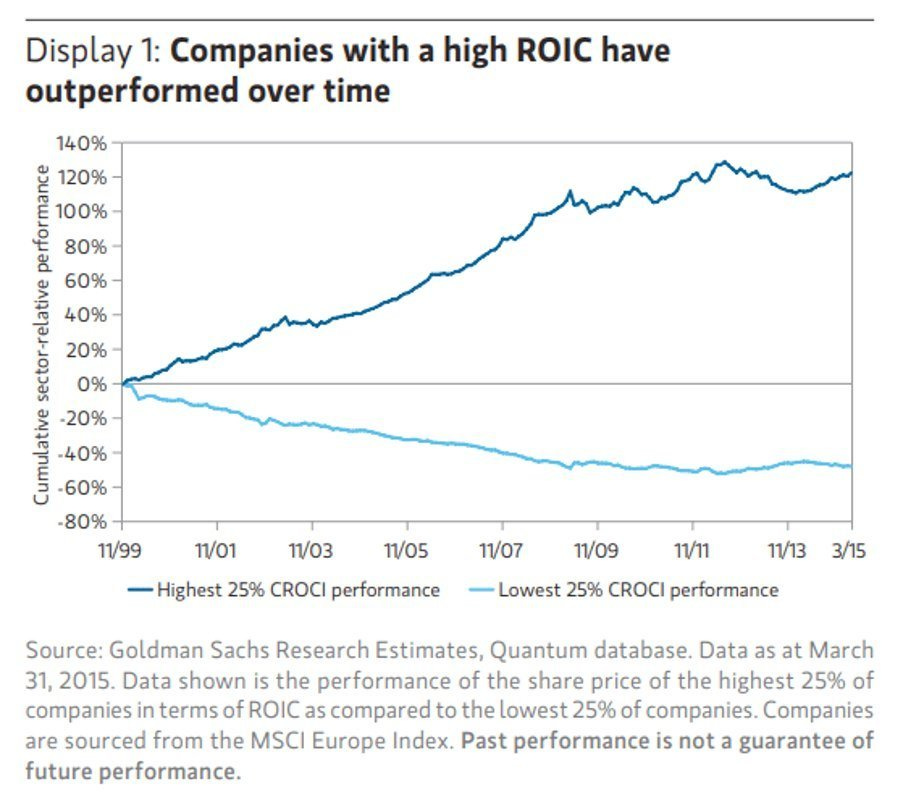

ROIC > 15%

For quality investors, Return On Invested Capital (ROIC) is one of the most important financial metrics.

It shows you how efficiently management is allocating capital.

Furthermore, a high and stable ROIC is a great way to look at a company’s competitive advantage.

If you want to learn more about ROIC, take a look here: What you need to know about Return On Invested Capital.

Net debt / FCFF < 5

You want to invest in companies which are in good financial shape.

A healthy balance sheet gives a company flexibility and protects them against unforeseen circumstances.

That’s why you would prefer to own companies which are able to pay down all their debt in at least 5 years.

Debt / Equity < 80%

Too much debt and leverage is never good.

If you’re smart you don’t need it and if you’re dumb you shouldn’t use it.

Can I screen for these criteria myself?

Yes you can.

Personally I use Bloomberg but you can also use free stock screeners.

Stratosphere is a free tool which allows you to screen for these criteria.

The only criteria you can’t screen for in Stratosphere is Net Debt / FCFF. As an alternative, you can use Net debt / EBITDA. Seek for companies with a Net Debt / EBITDA < 3.

If you are looking for more free stock screeners and other resources, take a look at this article: The best free investing tools.

Investment inspiration

You don’t want to do the work yourself?

No worries. I got your back.

Here’s a list with companies which match the quality criteria mentioned in this article:

Looking for even more inspiration? Here are a few articles I’ve written with example of Quality Stocks:

That’s it for today

That’s it for today.

Do you want to read more from us? Please subscribe to our newsletter where we provide investors with investment insights on a weekly basis. You can also follow Compounding Quality on Twitter and Linkedin.

If you have any questions, please email me:

About the author

Compounding Quality is a professional investor which manages a worldwide equity fund with more than $150 million in Assets Under Management. I’ve read over 500 investment books and spend more than 50 hours per week researching stocks.

This is the BEST investing email !

I read, speaking as an investment advisor for 22 yrs

I like FCF/Share growth i/o EPS growth